5 ways Voya is innovating to better employee and plan sponsor experiences

3 minute read

Our innovative spirit is driven by technology, human-centered design and deeper integration to help improve outcomes — for both employees and employers.

Read on for a quick overview of some of our latest innovations.

Enriched employee experience

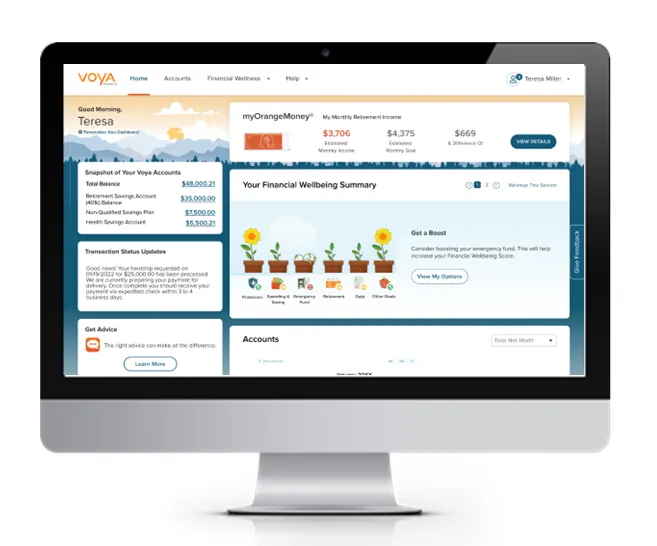

#1. New employee homepage dashboard experience that brings together an individual’s financial life

- Simple and comprehensive view of all Voya accounts together

- Connect external accounts in one place to view total net worth

- Understand overall financial strength and get personalized insights on how to improve financial wellness

- Automatic personal finance resources including budgeting, spending analysis and emergency savings

- Customize the experience based on goals and track progress along the way

#2. Deepening personalization within workplace solutions

Our myVoyage digital experience delivers holistic views of employees’ finances and workplace benefits along with AI-driven insights. With mobile and desktop versions, individuals can explore their finances in a new way — getting tips and guidance on how to live for today and plan for tomorrow.

Recent enhancements to the myVoyage experience include:

Personalized enrollment guidance tool allows for even greater personalization — it includes the employee’s actual coverage usage in its health plan guidance for the following year.

New personalized nudges based on claims insights will help employees see how much they’re spending on prescriptions, better understand the difference between in and out of network provider costs, understand the financial impact of emergency room visits and receive guidance that considers voluntary coverages available to them.

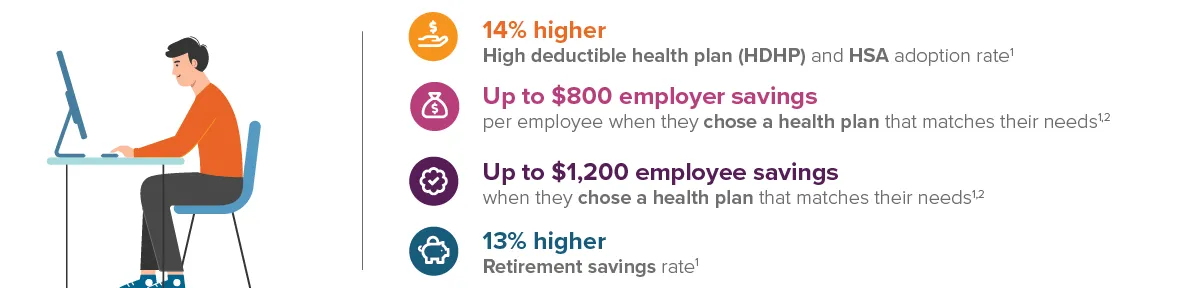

myVoyage delivers outcomes

Connecting health and wealth into a single financial picture, using a recent pilot customer experience to measure outcomes:

#3. Voya Retirement Advisors (VRA) powered by Morningstar

Voya Retirement Advisors (VRA) powered by Morningstar has been added to our suite of solutions for retirement plan participants.

- 1:1 support for participants to connect with VRA investment advisor representatives by phone or in person for personalized help with their retirement savings and planning goals

- Integrated experience within the participant website and mobile app

Enhanced employer experience

#4. Implementing the SECURE 2.0 Act - Voya is ready

Voya is ready to support the next wave of SECURE 2.0 provisions that are effective on January 1, 2024. Visit our online resource hub dedicated to helping employers understand and manage SECURE 2.0.

#5. Exciting thought leadership

Voya’s Thought Leadership Council in collaboration with The Voya Behavioral Finance Institute for Innovation develops unique perspectives on workplace benefits and savings topics, and uses research to inform our innovations and educate employers.

New paper: Amplify the power of HSAs to boost health care savings — now and in retirement

Today’s employees may be missing out on retirement savings. Learn how Health Savings Accounts can bridge the health and wealth gap and help improve financial outcomes for employees.

Explore related Voya Insights employer blog posts:

- 7 tips for effective health savings account (HSA) program design

- When it comes to saving for retirement, don’t forget about HSAs

- HSAs: 7 elements to include in your education strategy to help spark employee action

Voya continuously strives to be innovative, flexible and results-driven — helping both employers and employees take positive actions toward achieving a secure financial future. To learn more, speak to your Voya Representative or visit voya.com/future-of-benefits.

Related Items

1 Results from one pilot customer (Voya Financial) with a total of 6,410 employees eligible for the tool. 944 eligible employees used the tool (myVoyage app and Personalized Enrollment Guidance) Jan. 1 2022- Jan.1 2023. Actual results may vary.

2 Savings assumes average of 2022 healthcare costs for PPO and HDHP plans; KFF 2022 Employer Health Benefits Survey (source)

3 Based on the results of a Voya Financial Consumer Insights & Research survey conducted March 9-10, 2023, among 1,005 adults aged 18+ in the U.S., featuring 464 Americans working full-time or part-time.

Not FDIC/NCUA/NCUSIF Insured I Not a Deposit of a Bank/Credit Union I May Lose Value I Not Bank/Credit Union Guaranteed I Not Insured by Any Federal Government Agency

Neither Voya® nor its affiliated companies or representatives provide tax or legal advice. Please consult a tax adviser or attorney before making a tax-related investment/insurance decision.

Any insurance products, annuities and funding agreements that you may have purchased are sold as securities and are issued by Voya Retirement Insurance and Annuity Company (“VRIAC”). Fixed annuities are issued by VRIAC. VRIAC is solely responsible for meeting its obligations. Plan administrative services provided by VRIAC or Voya Institutional Plan Services, LLC (“VIPS”). Neither VRIAC nor VIPS engage in the sale or solicitation of securities. If custodial or trust agreements are part of this arrangement, they may be provided by Voya Institutional Trust Company. All companies are members of the Voya® family of companies. Securities distributed by Voya Financial Partners, LLC (member SIPC) or other broker-dealers with which it has a selling agreement. All products or services may not be available in all states.

This information is provided by Voya for your education only. Neither Voya nor its representatives offer tax or legal advice. Please consult your tax or legal advisor before making a tax-related investment/insurance decision.

Advisory Services provided by Voya Retirement Advisors, LLC (VRA). VRA is a member of the Voya Financial (Voya) family of companies. For more information, please read the Voya Retirement Advisors Disclosure Statement and Advisory Services Agreement. These documents, as well as information on fees, may be viewed online by accessing the advisory services link(s) through your plan's website. You may also request these from a VRA Investment Advisor Representative by calling your plan's information line. VRA has retained Morningstar Investment Management LLC as an independent “financial expert” (as defined in the Department of Labor’s Advisory Opinion 2001-09A) to develop, design, and implement the asset allocations and investment recommendations generated by the Advisory Services. Morningstar Investment Management LLC is a federally registered investment advisor and wholly owned subsidiary of Morningstar, Inc. Neither VRA nor Morningstar Investment Management LLC provides tax or legal advice. If you need tax advice, consult your accountant or if you need legal advice consult your lawyer. Future results are not guaranteed by VRA, Morningstar Investment Management LLC or any other party and past performance is no guarantee of future results. The Morningstar name and logo are registered trademarks of Morningstar, Inc. All other marks are the exclusive property of their respective owners. Morningstar Investment Management LLC and Morningstar, Inc. are not members of the Voya family of companies.

Voya Financial and its affiliated companies (collectively, “Voya”) is making available to you the Personalized Enrollment Guidance tool offered by SAVVI Financial LLC. (“SAVVI”). Voya has a financial ownership interest in and business relationships with SAVVI that create an incentive for Voya to promote SAVVI’s products and services and for SAVVI to promote Voya’s products and services. Please access and read SAVVI’s Firm Brochure which is available at this link: https://www.savvifi.com/legal/form-adv. It contains general information about SAVVI’s business, including conflicts of interest.

The Personalized Enrollment Guidance tool provides information and options for you to consider in making healthcare, health savings, emergency savings, and retirement savings choices. Those choices are solely up to you to make. Personalized Enrollment Guidance is not intended to serve as financial advice. None of SAVVI, Voya, nor WEX Health acts in a fiduciary capacity in providing Personalized Enrollment Guidance or other services to you; any such fiduciary capacity is explicitly disclaimed.

Health Savings Accounts offered by Voya Benefits Company, LLC (in New York, doing business as Voya BC, LLC). Custodial services provided by Voya Institutional Trust Company.

Products and services offered through the Voya® family of companies.