Why child care benefits can help employers and employees

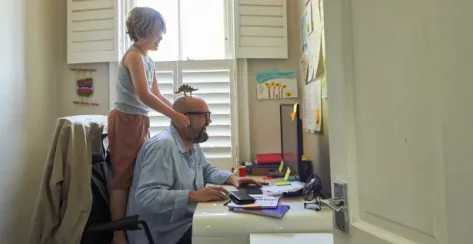

The national child care crisis hit home for Justin* when his two young children – Brendan (2) and Laurie’s (4) – childcare center closed abruptly last year. The center called parents on a Thursday afternoon to ask them to pick up their children immediately because they were short-staffed.

"I was shocked because it was in the middle of the day," says Justin, who works in logistics. Later, the center notified parents that they'd be closed the following week – or until they could find enough staff to re-open. It's a scenario that's played out across the country.

One in three households with young children (ages 4 and under) report having "serious problems finding daycare," according to a survey from National Public Radio and the Robert Wood Johnson Foundation.1

The pandemic has only exacerbated the ongoing child care shortage as providers struggle to find and keep workers. But while the issue is challenging for families, they aren't the only ones impacted. The child care crisis costs $57 billion in revenue, earnings, and productivity losses annually for employers and employees alike.2 Fortunately, employers have options and can offer benefits that can help lessen the child care challenges faced by working parents.

A deepening child care crisis

A shortage of child care resources was problematic before the COVID-19 crisis, and it's only gotten worse. A study by Child Care Aware of America reports that almost 16,000 child care centers shuttered between December 2019 and March 2021.3 The study shows that these closures were in part driven by a broken ecosystem. Part of the problem may be due to the low wages associated with the child care profession.

For example, the average child care worker earns just under $12 an hour, which means a quarter of all workers live at or below the poverty level.4 These low wages contribute to staffing shortages, leading to temporary and permanent closures. During the pandemic, illness and quarantines (of kids and care providers) added another level of unpredictability, which proved to be the last straw for some daycares and preschools. While further rate hikes to increase employee pay is an option, this could make care even more unaffordable for some families, who already dedicate an average of 10% of their income to child care costs.5

With all the challenges, securing consistent child care can be a daunting task. And that’s with ample lead time. Finding care with only a day or two of notice because a center abruptly closes? For many, that's not feasible. So instead, when faced with this situation, some working parents may struggle to find a solution that works.

Unfortunately for those without work-from-home opportunities, this can mean tardiness or absenteeism. According to a study by Council for Strong America, more than 60% of parents say they've left work early due to child care issues. Fifty-six percent have been late to work because of child care issues, and 55% have missed a whole day.2

The impact of this issue reverberates across companies and individual careers. Parents struggling with child care often miss career-enhancing opportunities, such as additional training and promotions. Women, and especially women of color, are disproportionately impacted. Faced with few child care options, many women put their jobs on hold. Consider that more than 2 million women left the labor force during the COVID-19 crisis, primarily to care for children.6

How employers can help

Employees can't wait for a nationwide solution to their child care shortage – they need help now. Thankfully, employers can support employees through this crisis with by offering smart solutions that help parents find and fund child care. Consider the following:

1. Alleviate the stress of finding care

Finding and vetting child care options can feel like a second job, replete with interviews, online searches and social media pleas. However, offering a caregiving service like Wellthy7 can help reduce this stress by helping employees find and access caregiving resources. Wellthy connects your employees with a dedicated care coordinator tasked with tackling the caregiver search.

Parents can use the service to evaluate and vet babysitting resources and part-time or live-in nannies. The company also helps parents access resources like:

- Academic tutors,

- In-home or on-site learning solutions,

- Afterschool activities and more.

Each parent is matched to a care coordinator who provides parents with choices based on their budget, needs, and other relevant circumstances, reducing the work of the search – and increasing the likelihood of finding care that works.

2. Make affording care easier

Finding child care is the first hurdle – and paying for it is the next. This is where a Dependent Care Flexible Spending Account (FSA)8 can make a meaningful difference. This type of FSA enables employees to save pre-tax dollars that can be used to pay for eligible dependent care expenses incurred while participating in the plan. Employees can withdraw the funds tax-free to pay for qualified expenses such as daycare, afterschool care, preschool, and even summer day camps. However, the children must be under 13 or other tax dependent who resides with the employee and is physically or mentally incapable of self-care.

The accounts do have a contribution limit in 2022 of $5,000 for married or single filers ($2,500 for those married, filing separately). And like other FSAs, the funds don't roll over year-to-year, so employees need to plan how much they want to spend annually. Employees must spend the entire balance before the end of the plan year or they will lose it. While some plans may offer a grace period or extender, that is determined by the employer.

Finally, employees can't use the child tax credit and a Dependent Care FSA simultaneously. That said, the tax savings provided by accounts give employees a way to make their child care dollars go further.

For those caring for children with special needs and/or aging loved ones, Voya Cares®9 offers several valuable informational resources, thought leadership and services to support caregivers in the workplace. Visit VoyaCares.com and connect with a Voya representative today.

3. Leverage Employee Assistance Programs (EAPs)10

Many employers offer EAPs as a mental health resource for employees, but did you know EAPs can also offer child care support or resources? Some EAPs offer employees personalized attention for multiple work-life needs, including help with finding child care.

EAP specialists can give referrals to child care providers and information about additional child care resources available to employees. In addition, the programs can connect parents to other resources that can help them stay mentally and emotionally well as they navigate work and family life.

A fit for families

For Justin, the sudden closure of his children's daycare highlighted the precarious nature of child care and how a change can upend life at work and home. It's familiar stress for families around the country. However, support from employers can help and encourage employees to stay engaged, productive and maybe even lessen the stress of navigating child care challenges.

By providing benefits that can help employees find child care and other resources for their needs, employers can reduce the burden on working parents and encourage a workplace that genuinely supports parents and families.

Interested in learning more about how you can best support your employees? Connect with a Voya representative today.

Related Items

*Names changed. Example based on real-life situation that occurred in 2022. Permission has been provided for its use. Actual results may vary.

- “Experiences of U.S. Households with Children During the Delta Variant Outbreak” survey. Conducted for NPR, the Robert Wood Johnson Foundation, and the Harvard T.H. Chan School of Public Health, October 2021.

- Bishop-Josef, Ph.D., Sandra; Beakey, Chris; Watson, Ph.D., Sara; and Garrett, Tom. “Want to Grow the Economy? Fix the Child Care Crisis” report. StrongNation.org/ReadyNation Council for a Strong America, January 2019.

- “Demanding Change: Repairing our Child Care System” report. Child Care Aware® of America (CCAoA), 2021.

- “The typical child care worker in the US earn less than $12 an hour.” The Conversation.com, published May 18, 2021.

- “Picking Up the Pieces: Building a Better Child Care System Post COVID-19” report. Child Care Aware® of America (CCAoA), 2020.

- Gonzales, Matt. “Nearly 2 Million Fewer Women in Labor Force.” SHRM, February 17, 2022.

- Wellthy is a separate entity and not a corporate affiliate of Voya Financial. All caregiver solutions provided by Wellthy.

- Flexible Spending Accounts offered by Voya Benefits Company, LLC (in New York, doing business as Voya BC, LLC). Administration services provided in part by WEX Health, Inc. The amount saved in taxes will vary depending on the amount set aside in the account, annual earnings, whether or not Social Security taxes are paid, the number of exemptions and deductions claimed, tax bracket and state and local tax regulations. Check with a tax advisor for information on whether your participation will affect tax savings. None of the information provided should be considered tax or legal advice.

- Voya Cares is not insurance coverage. It is a service offered through the Voya® family of companies.

- EAP services are provided by ComPsych® Corporation, Chicago, IL. Services are not available in all states.

This information is provided by Voya for your education only. Neither Voya nor its representatives offer tax or legal advice. Please consult your tax or legal advisor before making a tax-related investment/insurance decision.